How to Assess and Compare Your Value Against Your Competitors Using Value Curves – Part 1

The Challenge of Gaining Competitive Insights

It’s pretty clear why having a good set of insights into the competitive landscape that you operate in is vital to the success of your business. A solid understanding of the competition it is useful for many reasons, but there are two imperatives for the revenue team. The first, and most obvious, is to position your offering and its unique selling points. The second is to help steer future direction and how you describe your product roadmap, i.e. your future offerings. Without those the revenue team has a vastly reduced chance of success.

Developing a clear view of a competitive landscape can seem daunting. It is difficult to collect the information you need, but with some desktop research and networking you can often gather enough to work with. The real challenge comes in making use of what you have learned to make good decisions. Making comparisons is hard because every vendor applies a good level of spin to their story and often describes the same capabilities and outcomes in different ways.

Value Curves

This is where we have found value curves useful. We also found that as we learned to work with the data more systematically, it had a knock on making it easier to determine what data we needed.

Value curves are used to assess and visualize external, market-based competitive factors resulting in strategic profilesof competing products or companies. They are extremely useful in both product category and proposition development and in positioning against the competition – if you can estimate value effectively, which is something we have spent a lot of time working on.

The Value Curves Backstory

The value curves backstory starts with two Professors of Strategy, Kim and Mauborgne, and their 2005 book, “Blue Ocean Strategy”. Here they argued that the solution to business growth and success is to operate in an uncontested market, a blue ocean, rather than a much more competitive red ocean. This requires clear focus, differentiation from the competition and the ability to summarize that focus and differentiation crisply – typically in a compelling tag line.

That summary hardly does such an influential book justice but, but we are interested in the way the authors compare value.

Value Comparisons

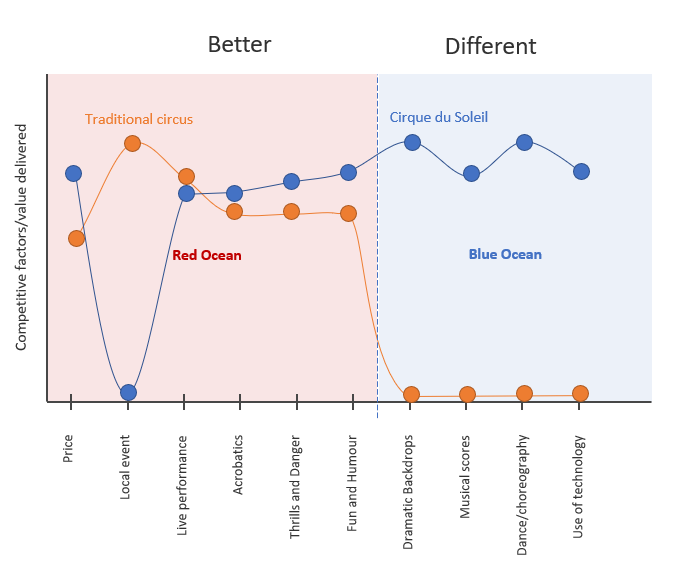

Where the value comparisons start is that blue ocean strategy makes use of what the authors call value innovation—an innovation that makes a product unique and superior to the competition. To help visualize strategy and determine whether it provides unique value, Kim and Mauborgne introduced a chart, they refer to as the strategy canvas – one of the many tools described in the book.

The Strategy Canvas

The strategy canvas consists of a two-dimensional line graph: On the horizontal axis are the characteristics of competition in the market – the factors of competition. The vertical axis represents the value placed on each of these factors. These are plotted on the graph as points, and connected and repeated for leading alternatives, creating a value curve.

An Example of a Value Curve

Let’s bring that to life with an example. Cirque du soleil is a market disrupter which profitably increased revenue 22-fold over a 10 year period by developing uncontested market space, despite a long-term decline in the circus industry.

To make things clearer, we’ve colour coded the factors common to all competitors red and those unique to you blue. We’ve labelled those ‘Better’ and ‘Different’.

Cirque de Soleil Value Curve versus the traditional circus

The Secret Sauce for Creating Value Curves – Value Estimation

Value curves are created by plotting the key market criteria or “competitive factors” on the horizontal axis of the graph. The vertical axis shows the ’value’ of each of these criteria. The question is – how do you estimate value?

We use two methods of estimating value.

The first is Value delivered to the customer – assessed by impact on tasks, roles, processes etc. This is a technique we developed during consulting engagements. See the table below for details. We prefer to score value (using numbers from the Fibonacci sequence as is conventional with Agile Estimation) but assessing using T shirt sizes can also work well.

| Value Score | T shirt Size | Extent of Impact | Value Label |

| 1 | XS | Little or none | Don’t care |

| 3 | S | Impact on tasks (outcomes, time taken etc.) | Useful |

| 5 | M | Impact on specific role(s) and/or process | Valuable |

| 8 | L | Significant impact on role(s) and/or process | Extremely valuable |

| 13 | XL | Significant impact on roles, processes to the point where the impact is considered to improve the operations of the company | Transformational |

Table 1: Scoring competitive factors based on value delivered to the customer

The second method is to asses where you and the competition place most value, measured by what you invest in. This is a common method is documented on the internet.

| Value Score | T shirt Size | Extent of Investment | Value Label |

| 1 | XS | No investment | Zero investment |

| 3 | S | Minimal investment – typically at a departmental level | Small investment |

| 5 | M | Moderate investment – A large departmental investment, but still moderate at company level | Moderate investment |

| 8 | L | Significant investment – this investment is large enough to be on the radar of the CFO | Large investment |

| 13 | XL | Major investment – this is one of largest and most strategic investments the company makes | Strategic investment |

Table 2: Scoring competitive factors based on investment

Conclusion

The main advantage of value curves of how easier they are to read, as they are both simple and visual. Which makes decision making easier. Where many struggle is how to calibrate value, and we’ve found that the approaches we’ve described here are both helpful. No doubt there are others. Please let us know of any you have discovered.

In the second part of this article we will review how to and use value curves based on the work we’ve done here in assessing the relative value of the competition.